Can People Become Market Makers In The DeFi Market? Overview Of The Capabilities Of Janis Balodis’ Platform – DEXIMUM

Each of the classics of trading was looking for his own Grail – a tool with which it would be possible to change the world and beat the global financial system. The result of which was a loss of 97% of traders around the world.

Hundreds of years ago, Richard Wyckoff drew attention to the fact that the markets are controlled by some “invisible hand” – the market maker. Bluntly, a market maker is a trader who has influence over pricing, or a group of individuals who own unlimited capital with which they can control the market.

Most of the money in the market is concentrated in the hands of market makers, and the volumes they drive are enormous – as are their revenues. Income here is guaranteed only to the market maker while in principle, there should be no guaranteed income to anyone.

Can you become a market maker? Here we must sadly disappoint you: in the traditional stock market, the roles have long been assigned, and the market maker in this domain also acts with the accreditation of government agencies. This is a much-prized position, which, regardless of all the desire looming over it, neither companies, nor even private traders can freely become.

However, there is today one field where anyone can theoretically become a market maker – the cryptocurrency market. The fact being that, due to its youth and progressiveness, the cryptomarket is not “regulated” by state entities and, in principle, is open so that any of its participants can have a sky-rocketing career – the only requirements being desire and seizing opportunities.

Liquidity – the most valuable commodity in the cryptocurrency market

In the cryptocurrency market, the market maker is not yet the unattainable mysterious figure that he is in the world stock market. Traditionally, a market maker can either be a crypto hedge fund or any company that has adequate opportunities to support exchanges. However, for the cryptocurrency market, a market maker plays an essentially simple role: it provides exchanges with liquidity. This represents the amount of money that allows trades to be carried out quickly and without delays – both of which are extremely important for a good exchange, since it is thanks to them that traders do not miss out on profitable deals.

In the cryptocurrency area, with its characteristic asset value volatility, the work of the exchange should be especially clear and debugged like a clock. Therefore, a market maker who is ready to provide a cash reserve for traded assets, and in double the amount, is an important and valuable market participant with its own preferences and benefits.

Imagine what opportunities would open up for you if you could become a market maker in the cryptocurrency market – someone who receives a guaranteed profit from every transaction. And although theoretically you have this opportunity, in practice everything is not so simple: the amount of funds that you must have at your disposal must be huge, which means that the task of a market maker is still within the power of only a select few.

Nevertheless, there is one important maxim, based on which a completely new direction in the cryptocurrency market was born. This maxim goes like this: for the crypto market, liquidity is the most valuable resource that is constantly in short supply, because this market is growing at a tremendous pace, and at the same time, due to its decentralization it is desirable that the market-makers are not just some large whales who manipulate, and represent globally distributed communities.

As an answer to the desire of getting rid of these “manipulators”, directions such as “crowdsourced market making” appeared.

Deximum platform and crowdsourced market making

Liquidity has long been a central issue not only for cryptocurrency and blockchain projects but also for financial markets in general. This is an absolute prerequisite for the growth of any plan. The problem of liquidity that’s emanating from a centralized organization is that it counters the very spirit of decentralization that underlies crypto-economics. As a result, we get the same sad picture full of manipulations, pumping, and dumping assets as in the traditional market – so how, might you ask, does the crypto market differ from the stock market? The answer is a simple and quite an original one – crowdsourced market making

The inventor of the new direction was the Deximum platform, which seeks to provide the cryptocurrency market with fair opportunities, where investors can collectively act as a market maker, receiving profits corresponding to this status, while the market gets rid of the threat of centralization. Deximum seeks to bring decentralized finance to the masses, opening up huge financial opportunities for crowdsourced market-making participants, opportunities, which were previously available only to “whales”.

Currently, the main task of the platform is to attract experienced traders who understand the dynamics and laws of the cryptocurrency market, however, further in the project roadmap, it’s planning on scaling to the level of the general audience with an involvement that’ll allow the platform to reach a multimillion audience.

The idea is as simple as it is ingenious: platform users provide their assets to a common pool and are compensated for the fact that operations on cryptocurrency exchanges are carried out with the help of these assets. When liquidity is indeed crowdsourced from a diverse audience, whose behavior and interests are unrelated, liquidity is fundamentally more resilient. It is less likely to evaporate in a crisis and is more indicative of a healthy market. This is a fundamental rethinking of liquidity, which is one of the most important requirements for all financial assets and trading floors. Crypto exchanges and token issuers spend, according to rough estimates, $ 1.2 billion a year to compensate market makers in the form of discounts, fees and other costs to maintain liquidity reserves. Market making with the involvement of crowdsourcing is fundamentally changing the situation, both for users of exchanges and for the trading platforms themselves.

Deximum invites everyone to act as market makers, providing them with favorable conditions including a low level of risk and solving the key problem of technical restrictions for trading. With the help of crowdsourced market making, the company allows market participants to earn on liquidity, in other terms: multibillion-dollar volumes on the market, plus unlimited earning opportunities. With this assistance, the users create a pool of their assets and receive a commission for operations carried out with their use on cryptocurrency exchanges. In addition to the commission, liquidity providers receive additional rewards:

–% of net profit during the entire period of use of their assets;

– unlimited Airdrop for the most active audience;

– exchange bonuses in the amount of 1% of the liquidity of your clients’ network on the exchange.

– incentives for users who provide long-term liquidity;

– the issue of DSTo tokens, of which the holders receive cashback for a commission.

Decentralized exchange from Deximum

Deximum is committed to creating the most convenient and innovative form of decentralized cryptocurrency exchange, and the company is ready to create such a turnkey, custom-made exchange with crowdsourced liquidity. The model offered by Deximum is called the DexiSwap Exchange. This is a new word in the technologies of decentralized exchanges: the unique DEX architecture from Deximum ensures a super-productive trading process due to the use of liquidity pools in crowdsourcing, on the one hand, and full automation of the trading process, on the other. Thanks to the innovative design of the system, trading operations are performed instantly, thereby protecting users from losing funds due to unclosed transactions.

For the B2B sphere, Deximum provides its unique product – the creation of a fully ready-to-use decentralized exchange for the client’s requests. The package of services includes setting up and putting into operation DEX, the efficiency and speed of operations of which will be provided by its pool of Deximum liquidity. For the created exchange, Deximum provides market-making services, that is, it provides full support to a result that can satisfy the most demanding client. The Deximum trading algorithm improves the performance of the exchange by leveraging the liquidity that individual investors provide to close traders at the best possible price.

DSTo platform token emission and airdrop

The Deximum economy is based on the DSTo platform’s token, an ERC20 standard token that runs on the Ethereum blockchain. Participants who provide liquidity to the platform through crowdsourced market making can receive a token. The team plans to integrate the DSTo token into DeFi protocols and use it as a vehicle to massively attract liquidity providers to the platform.

It will work as follows: for replenishing the liquidity pool, each participant will receive a percentage in the form of DSTO tokens from the volume of their funds that are in the pool. Cashback in the form of tokens can be sold and received as real additional income. It is important that at the time of sale, DSTo tokens are burned, while assets equivalent to their value are unfrozen and credited to the user’s account. The cost of DSTo is not fixed: the burning mechanism and the growing influence of the Deximum platform allow the DSTo rate to grow constantly.

Thus, the token will become the main source of profit for platform participants thanks to the constant growth in value. The release of new DSTo on the Deximum platform is carried out only if there is collateral, and its volume must always exceed the value of the issued tokens – today the value of the collateralized assets is 350% higher than the price of the issued DSTo. In total, 50 thousand DSTo are put into circulation in each cycle of emission; now the cost of the token is $ 0.15. It is expected that soon enough, the cost of DSTo will rise to $ 0.50, which makes the increase in the token rate one of the important factors in making money on the platform – in addition to the direct reward for providing liquidity.

The reward itself is credited in DSTo from each trade operation performed using Deximum liquidity pools, and its size depends on the period during which the liquidity is provided and the actual size. In addition to rewards, crowdsourced market making participants receive significant perks in the trading process – a partial refund of the commission for personal trading operations.

DSTo can also be obtained through an unlimited airdrop by either relying on the distribution of tokens under the partner reward program, or by simply attracting new users to the platform. The affiliate program includes 35 levels, and depending on the level of the participant, the amount of remuneration will be different. By attracting referrals to the collective market making program, the participant receives bonuses from their liquidity, and these bonuses are awarded in the currency that the invited person provided to the platform.

Deximum team: experienced enthusiasts in their field

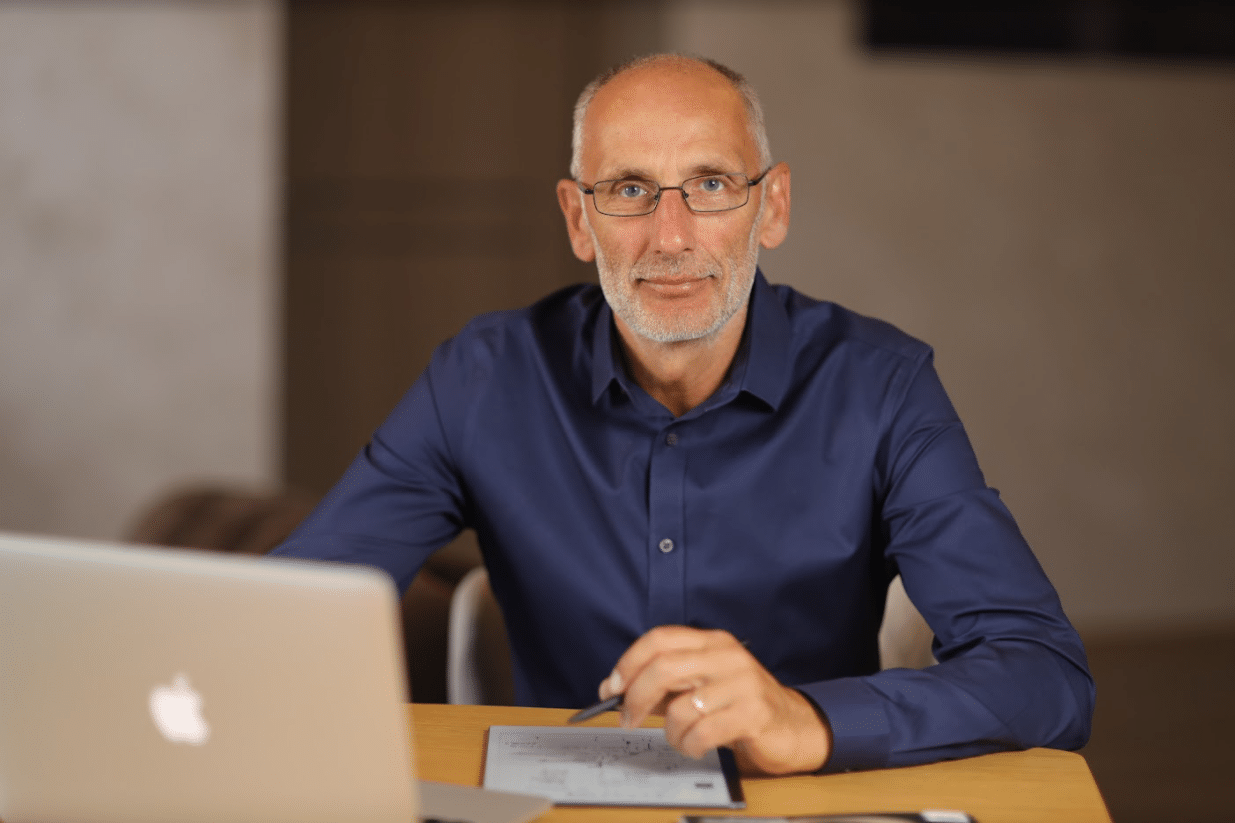

The Deximum team consists of tremendously talented specialists who left the Euro-Asia Hub, and began developing a joint project during the pandemic. The CEO of the project is an international businessman and well-known marketer in professional circles – Janis Balodis.

(Janis strengthening his ties with the Indian government)

During his 30 years of entrepreneurial activity, Janis served as a member of the Latvian Chamber of Commerce, was the founder of the European Institute of Biometrics “Alpha”, participated in the development of international trade projects such as OTTO Interiors Ltd and Uganda Capital Holdings – which are companies that today occupy leading positions in the East African market.

(Janis Balodis)

Balodis became interested in cryptocurrencies in 2018 – he saw a huge potential in this area, and since then he has been promoting blockchain projects. His design expertise has always enabled Janis’s team to create a simple, understandable and user-friendly product for a mass audience. Balodis sees his main task at Deximum as creating an attractive project concept for investors and bringing up the site to become one of the top 5 world DEX platforms.