Wall Street Executives are Moving Into Crypto, Optimistic over the Long-Term

Executives at Deutsche Bank AG, Goldman Sachs, BlackRock, and Barclays have resigned from their high-paying and stable careers to enter the cryptocurrency market in 2018, after finding better opportunities in the rapidly and exponentially growing blockchain industry.

BlackRock Investor’s Story

Asim Ahmad, a former trader at BlackRock, resigned from the company after generating enough capital from his investment in ether, the native cryptocurrency of the Ethereum blockchain network.

“I’m in a position where it doesn’t make sense to work at BlackRock anymore. The one-day volatility of my portfolio is higher than my salary, so if I get a few investments right then I’ll have made the same as my yearly wage and everything else on top is a bonus,” said Ahmad.

Ahmad first invested in ether in 2016, around the same time he was offered a position at BlackRock in London. He invested all of the savings he had garnered at his stay at an investment consultancy in Northern England which amounted to $13,250.

Profiting from Ether’s Rise

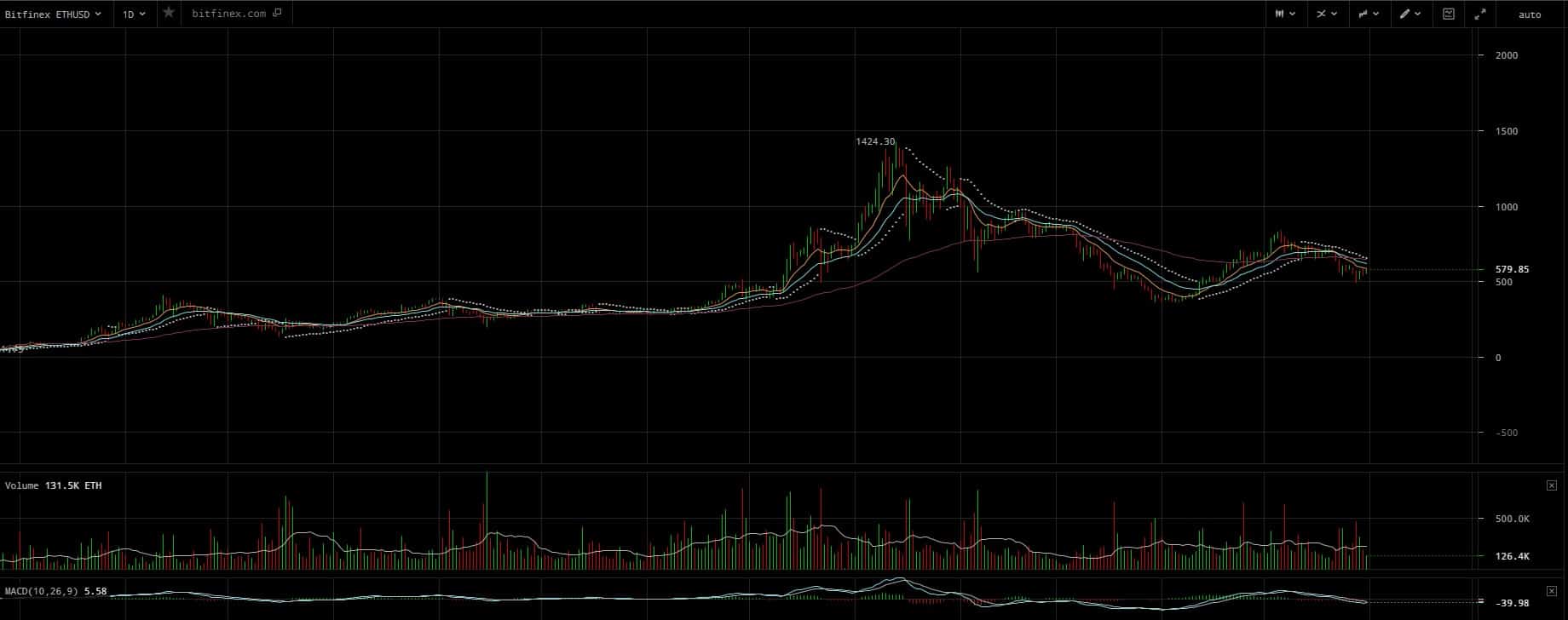

In early 2016, ether was worth $1. Ahmad invested in ether when the price of the cryptocurrency increased to $10. As of May 31, ether is worth $581, resulting in a 58.1-fold return for Ahmad within a two-year period. The $13,250 savings Ahmad invested in 2016 are now worth $770,000. At its peak, ether was valued at $1,400, placing Ahmad’s return at around $1.85 million.

However, for many young traders and middle-aged executives, leaving the traditional finance sector carries more significance than merely producing more money for personal satisfaction. A former Barclays trader, who left the UK bank to join bitFlyer, Japan’s most significant cryptocurrency exchange, took a substantial pay cut to enter the cryptocurrency sector.

Banks will Become Obsolete, Cryptocurrency is the Future

Daisuke Murayama explained that during his stay at Barclays, he strongly felt that the products and services provided by banks and large-scale financial institutions will be rendered useless in the upcoming years, due to the emergence of innovative technologies and forms of money like cryptocurrency.

“I just didn’t see a future in traditional finance,” said Murayama, adding that the finance sector is “never coming back.”

At the time, Tokyo-based financial consultancy NTT lead fintech researcher Yoshiharu Akahane stated that banks in Japan and Asia have started to face negative interest rates and dismiss thousands of employees on a yearly basis to reduce headcount and expenses.

“Japan is facing long-term headwinds including negative interest rates, which is driving headcount lower at finance firms. That coincides with our huge crypto boom, which is much stronger than in the rest of the world, and explains why more people may jump to the crypto industry,” Akahane explained.

Crypto Sector is Stealing Talent

The ambitious, risky, and confident decision of executives at major banks to resign from their high-paying positions to enter the cryptocurrency market can be attributed to three primary factors:

- More significant opportunities in the cryptocurrency sector,

- The rapid growth rate of the cryptocurrency industry,

- The uncertainty regarding long-term future of banks and the traditional finance industry.

Chris Matta, a former Goldman Sachs money manager who quit the U.S. bank to create a cryptocurrency investment firm in 2017, stated that crypto has been successful in pulling away real talent from the financial sector.

“Crypto is certainly a market that’s pulling away real talent from financial services,” Matta said, emphasizing that millennial and young investors see more potential in the cryptocurrency market.